The earlier scepticism regarding its security has now finally given way to trust across all classes and ages. People no longer think twice before transferring money via mobile wallets; be it a teenager who is out partying with friends or a 50-year old businessman at the airport. What has further transformed the fate of mobile wallets – making it no less than a revolution with millions of downloads – is the campaign of ‘Digital India’. And its impact and centrality are such that people can now step out of their homes without their wallets!

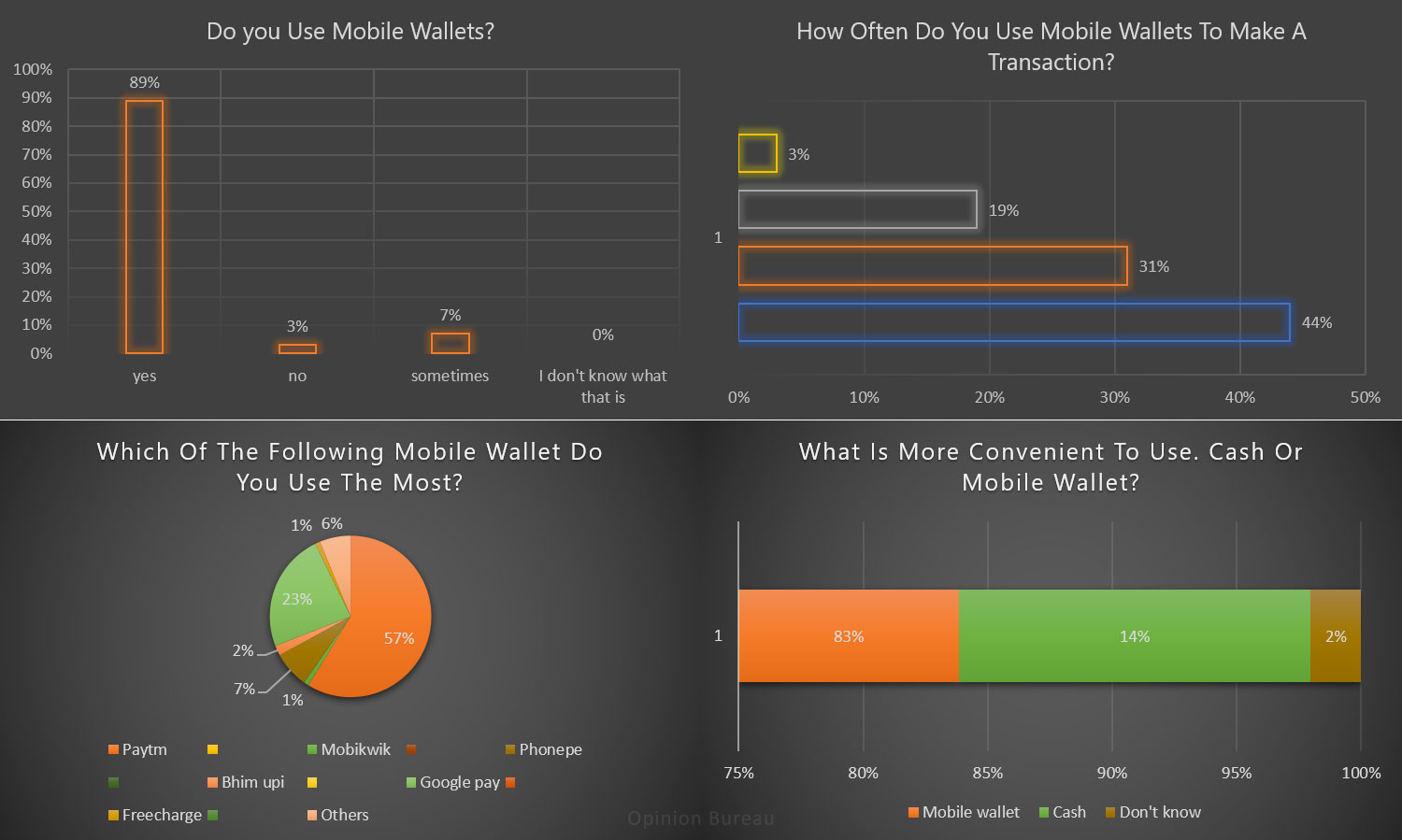

To get a better insight into the usage of mobile wallets in India, we at Opinion Bureau, conducted a poll on mobile wallets with 660 respondents. A whopping 89% of the respondents said they used mobile wallets with only 3% denying its usage at all. 7% of the respondents said that they ‘sometimes’ relied on mobile wallets while there was none who hadn’t heard of mobile wallets as a concept.

On trying to gauge the frequency of use, the poll revealed that 44% of users use mobile wallets on daily basis and 19% use it for two to five times a week. 31% respondents agreed on using them at least once a week and a small minority of 3% said that they ‘never’ used mobile wallets.

A clear winner in PayTM emerged with 57% respondents in trying to understand which mobile wallet was used most often. Google Pay followed with 23%, Phone Pe with 7%, BHIM UPI with 2%, and Mobikwik and FreeCharge with 1% each.

What couldn’t be ignored was the 6% users who used ‘other’ formats of mobile wallets, simply highlighting the extent of usage of mobile wallets without any inhibitions about their brands.

Mobile wallets are now hurtling towards replacing cash altogether with their single-minded proposition of convenience. All communication is geared towards promoting ease that seems to agree with our survey wherein 83% of users believed that mobile wallet is more convenient to use than cash. 14% of the users still chose cash over the new method of payment and 2% of the respondents are yet to make up their minds on the subject. What’s left to see is whether these mobile wallets and their convenience is here to stay or fizzle out with time in face of a stiff competition from a cash-loving economy.

All-in-all, mobile wallets seem to have become an irreplaceable part of our lives. From auto rickshaws drivers to vegetable vendors to swanky restaurants, all seem to have adopted to mobile wallets for good. There are no more “khulle nahi hai bhaiya” (I don’t have change) shenanigans. The only downside, therefore, seems to be the loss of melodies and eclairs in place of loose change. But we can live with it, can we not?

16 replies on “Mobile Wallets – Indian Economy 2.0”

the wallet ok but i still like to pay with cash or cards

Government tend a policy one man, one phone, one sim, one kyc, one wallet, one bank etc. to a person to catch and avoid cyber crime

All right

I like it 👍

Wallets safe our some personal docs 👍

hgh wachstumshormone kaufen

References:

git.scene.to

hgh kaufen deutschland

References:

writeablog.net

hgh apotheke kaufen

References:

evogene hgh kaufen

hgh steroids side effects

References:

https://kition.mhl.tuc.gr/kenburdette593

steroids online uk

References:

http://www.nemusic.rocks

how to use steroids correctly

References:

share.pkbigdata.com

This hints at decreased LV compliance, i.e., increased LV stiffness.

Notably, all parameters returned to baseline at the finish of follow-up.

However, this doesn’t preclude the chance that these

changes would possibly become everlasting with extra prolonged

AAS use or with repeated cycles that provide too little time for restoration to happen in between.

One of the first mechanisms by way of which steroids exert their effects is by elevating

testosterone levels within the body. This surge in testosterone can yield quite a few constructive outcomes, including heightened strength.

Users frequently report being ready to push themselves harder throughout

training periods and spend more time within the health club,

fueled by elevated vitality levels. In addition to selling fat

burning, elevated testosterone levels supply a myriad of benefits, including mood enhancement

and improved bone well being. By strategically optimizing testosterone ranges, individuals can improve their overall well-being

whereas achieving their fat loss goals. Remember, adhering

to the recommended dosage prescribed by

a certified sports activities doctor is essential

when utilizing steroids. Resist the temptation to exceed dosage

guidelines in pursuit of faster outcomes, as this method can lead to

antagonistic effects and potential liver damage.

Many fitness lovers are turning to authorized alternatives that present comparable benefits with out legal

problems. Accel Pharma has developed compliant formulations that

help muscle growth whereas adhering to Canadian regulations.

For those on the lookout for secure and authorized performance enhancers,

pure supplements and authorized steroid options from respected sources like Steroidscanada.store

can be an effective possibility.

The antagonistic results of AAS use depend on the product,

the person’s age and intercourse, how much they use, and for a way long.

AASs travel by way of the bloodstream to the muscle tissue, the place they bind to an androgen receptor.

The drug can subsequently work together with

the cell’s DNA and stimulate the protein synthesis course of that promotes cell growth.

Other reasons to be used might embody therapeutic or recovery and enhancement of metabolism.

In our top 10 legit steroid websites article, while getting ready the list, we paid consideration to picking sites

that attach importance to cost variety and provide dependable service.

New Dragon Pharma merchandise have been added to our store,

together with a quantity of peptide options and Dragontropin. Your private

knowledge will be used to assist your expertise all through

this website, to manage access to your account, and for different functions described in our privacy policy.

We don’t just need you to hit your goals we wish you to really feel strong, assured, and well-supported along the method in which.

Women need to be very cautious with the anabolic steroids they

use, as we now have discovered many trigger masculinization. Contact Support for Anavar Orders example,

testosterone can enlarge a woman’s clitoris and decrease her breast dimension. However,

not all individuals reply the identical (just

like with anabolic steroids), so some people could

make extra features than others. A person’s training and food regimen are additionally essential in determining outcomes.

For greatest outcomes, it should be stacked with different legal steroids,

as results are minimal with HGH-only cycles in our expertise.

The most outstanding major international locations on the earth the place anabolic steroid use is most prevalent

will be coated here. Glorious high quality of steroids and

ancillaries All gear that you can purchase in our store have been tested

and received directly from the producer. We assure that every one steroids bought from us are high quality and dependable.

A Swedish national population-based cohort study discovered a cardiovascular

morbidity and mortality fee twice as excessive in people

who tested optimistic for AAS use compared with those that examined

adverse (149). Suppression of spermatogenesis results in testicular atrophy, which

is mainly a beauty issue, although some men subsequently complain of retractile testes.

The seminiferous tubule compartment of the testis, which

hosts spermatogenesis, occupies about two-thirds of its quantity (186).

You can use a pill cutter to split the dose, or you can go for smaller doses (5 mg) when buying methandrostenolone.

It’s unknown exactly why Chris did this; nevertheless, his spouse Nancy filed

for divorce in 2003 after suspected domestic abuse left her fearing for her life (29).

We have skilled the most effective results when combining a topical retinoid with a topical antibiotic.

You should use the antibiotic (containing benzoyl

peroxide) in the morning and the retinoid at evening.

Jay Cutler proves that not everyone who takes steroids for years goes bald.

Milk thistle is part of the daisy family and has

been used in medicine by historic herbalists and physicians

to treat those with liver illness.

It must be noted that cuff dimension was adjusted according to higher

arm circumference in the HAARLEM examine, and thus the results were

not affected by this issue (46). The detrimental results of those seemingly small will increase in blood

pressure shouldn’t be underestimated. Whereas it is exhausting to estimate their influence on CVD risk,

one may try and quantify it by looking on the – well-researched – effects of blood pressure-lowering treatment.

Each 10 mmHg reduction in systolic blood pressure reduces the danger of main cardiovascular events, coronary coronary heart illness, stroke, heart failure, and all-cause mortality by 20%,

17%, 27%, 28%, and 13%, respectively (95). A persistent pharmacological

increase in blood stress – similar to attributable to AAS use – could be alleged to

have the inverse impact.

Each from time to time a clinical endocrinologist will be visited by a affected

person that makes use of anabolic androgenic steroids

(AAS) or has been utilizing them prior to now. The interaction between physician and patient may be hampered for

a selection of causes. First, some docs could really

feel reluctant to help a affected person who has self-inflicted well being

points because of the use of banned substances.

Trenbolone is a well-liked anabolic steroid utilized

by bodybuilders to construct muscle and burn fats. Primarily, trenbolone is utilized

throughout bulking cycles to add important quantities of lean mass with out the bloating and water retention of different anabolic-androgenic steroids.

Steroid abusers will overdose as a lot as a hundred

times greater than the really helpful dose of anabolic steroids

and that is called Steroid Overdose. A apply called stacking entails taking two doses of various kinds of anabolic steroids

to attain an accelerated effect. In the practice known as “cycling Steroid Overdose,” Steroid

Abusers alternate intervals of excessive dose and low dose and

typically no drug in any respect.

On-cycle remedy will concentrate on defending your liver, kidneys,

and cardiovascular system. Even low doses of PEDs can pose a threat,

however frequent sense actions can minimize the possibility of great problems.

A Clenbuterol cycle should be quick and start at

a low dose, particularly if it’s your first time. You will need to evaluate your response to this drug before raising the dose.

Sometimes, Clenbuterol dosages will improve as your cycle

progresses to make sure your physique doesn’t turn out to be

used to the decrease dose, which might cause stagnant results.

Some females are known to take 10mg and have it tolerated, but be ready for some unwanted effects

to develop. If, for whatever reason, you need to go along with injectable Winstrol over

oral (perhaps to keep away from liver toxicity), 20mg every four

days is an ideal dose.

Your supplier will assist you to perceive the dangers

and advantages before you begin any new treatment. For instance, steroids may stop the sort of worsening of

kidney inflammation that can cause kidney failure in individuals who have

autoimmune diseases like lupus or vasculitis. They

could assist these people keep away from needing kidney dialysis or a

transplant. There are lots of alternative ways

your provider would possibly give you a steroid. They might

apply it domestically, which implies a focused dose to an actual location in or in your

body.

Each steroid has a different chemical construction, and even slight variations can alter the

pace at which it’s metabolized or how lengthy the steroid’s metabolites will stay within the body (and hence, its detection time).

With newer scientific advances, anti-doping testing can detect long-term metabolites

higher than ever. Breakthroughs have resulted in detecting specific steroid metabolites for twice so

long as previously attainable. This signifies that

solely remaining traces of metabolites might slip previous

the drug testing strategies; these traces can now

be picked as much as return a constructive result.

Testosterone is predominantly administered by way of intramuscular injection; nevertheless,

it’s also available orally (known as testosterone undecanoate).

Dianabol is also liver toxic, being a C-17 alpha-alkylated steroid, thus having to cross through the liver so as

to turn into lively. If you’re abusing steroids and wish to stop, be honest with your doctor

to get the best support. To reduce irritation with out steroids, dietary adjustments may

be useful.

While steroids are usually used for their performance-enhancing and physical effects, you will want to note that they may even have mental

health and psychological results as properly. Nevertheless,

as famous above, carcinogenic results have been attributed to treatment with androgenic hormones.

The potential carcinogenic results likely happen through a hormonal mechanism rather than by

a direct chemical interaction mechanism. In patients with breast cancer, anabolic steroid therapy could cause

hypercalcemia by stimulating osteolysis.

Not solely does Equipoise help to advertise the expansion and restore of muscle tissue, however it has additionally been discovered to considerably enhance

an individual’s energy levels and total ranges of athletic efficiency.

When contemplating eq cycle options, it’s important to remember

the eq steroid pros and cons. While the benefits of Equipoise are quite a few, it’s essential to

manage Equipoise dosage accurately to avoid potential unwanted effects.

Moreover, users usually notice improved recovery occasions and elevated

vascularity, making equipoise bodybuilding results very appealing.

Selective androgen receptor modulators (sometimes known as particular androgen receptor modulators or SARMs) have been checked out as popular dietary supplements amongst fitness fanatics and chiseled athletes.

Because they’ve long been thought to be less dangerous than steroids for those trying to

bulk up fast. In fact, though, SARMs could additionally be more dangerous than we initially thought as a outcome of they may cause widespread issues on your

physique.

References:

Programa completo de suplementos para corpo rasgado

This is because Anavar side effect management guide is an anabolic steroid, meaning it works by increasing the production of proteins within the physique.

Additionally, a study performed by the University of Padova discovered that Anavar use can result in a lower in testosterone levels and an increase in sex

hormone-binding globulin (SHBG) ranges. This is due to the improve in estrogen (female hormones) attributable to an excess of androgens within the body,

as both come from the same metabolic pathway.

We have aimed to include all data whereby data about human topics can be

found, including the case reviews. Moreover, this text also

presents meta-analysis of reproductive hormones,

semen parameters and testis measurement. The medication in question are anabolic androgenic steroids (AAS), artificial derivatives of testosterone that are primarily utilized by fitness center aficionados

to extend muscle mass and obtain a muscular physique.

Healthcare suppliers prescribe them for certain conditions, such as male hypogonadism

and sure forms of breast cancer. Other exceptional

findings in our examine included the high fee of abnormal semen findings (79%), the significant delay

in spontaneous restoration within the untreated group, and the considerable share of

patients presenting with infertility. Being conscious of the potential results

of anabolic steroids in your body can make a major distinction.

Smit et al.[23] followed up 100 males voluntarily intending to begin an androgen cycle.

These values dropped on the cycle finish to 0.1 and 0.1; recovering to three.2 and a pair of.8

at three months and 4.1 and three.1 at 1 yr, respectively (all values are mean in mIU/ml).

TT values at baseline, end of cycle, three months and 1-year

testosterone levels had been 10.60, 23.01, four.26 and 4.forty

nine ng/ml, respectively.

The mechanism of testosterone abuse leading to

male subfertility has not been enunciated clearly.

Consumption of exogenous testosterone and other AAS results in suppression of secretion of GnRH from the hypothalamus which subsequently decreases the secretion of LH and FSH from the

pituitary gland [17]. Thus, because of low ranges of LH, endogenous testosterone production from

Leydig cells decreases resulting in low intratesticular testosterone however regular serum testosterone due to contribution from

exogenous testosterone.

AAS inhibit the body’s physiologic endogenous testosterone synthesis, and chronic ASA also has adverse effects on a

quantity of organ systems(10). Opposed results in men include sexual dysfunction, heart problems, endocrine abnormalities, psychiatric dysfunction, and hepatotoxicity(11–13).

Impacts on sexual operate include testicular atrophy,

reduced sperm count, impotence, and infertility(14).

Currently, both the American Urological Association and the Endocrine Society advocate against

testosterone remedy in men who want to preserve their fertility(15,

16). To the best of our knowledge, this is

the first study examining danger components for

relapse of AAS use amongst males with infertility.

Therefore, leptin levels could characterize a metabolic sign, which offers

a hyperlink between adipose tissue, vitality availability and the

HPO axis [17]. In this regard, the “metabolic fuel” speculation has been postulated, assigning to the vitality availability per se a task in the regulation of the HPO

axis operate. In Accordance to this speculation, the negative energetic balance,

greater than the fats mass content material, would

be liable for reproductive dysfunction in exercising girls [4].

In deep detail, an vitality availability below 30 kcal/Kg/lean physique

mass [LBM]/day has turn out to be the most effective

explanation for exercise-induced reproductive disturbances,

particularly in lean athletes [5–7]. The

negative power steadiness would stimulate compensatory mechanisms,

which in turn translates into HPO axis suppression [8].

Anabolic steroids, scientifically generally known as

anabolic-androgenic steroids (AAS), are synthetic substances that mimic the position of testosterone,

the male sex hormone. Their anabolic properties help in muscle constructing, while androgenic

options influence male traits and reproductive exercise.

These are to not be confused with corticosteroids, that are prescription drugs generally used

to help reduce inflammation and suppress the immune system.

(Again, “steroid” simply refers to a compound with a

specific chemical structure.) Corticosteroids

are used to treat a selection of circumstances, like bronchial asthma,

arthritis, eczema, lupus, and a number of sclerosis, as properly

as short-term infections that trigger inflammation. A “steroid” is

a kind of compound with a specific chemical construction, together with many hormones, alkaloids, and nutritional vitamins.

“Anabolic” refers again to the strategy of build up (muscle

or bone), also called biosynthesis.

For recommendation on the best food plan and (healthy!) dietary supplements examine our

article on tips on how to enhance sperm well being. Over the previous four years, we now have spent over

123,000 hours researching food dietary supplements,

meal shakes, weight loss, and healthy dwelling. Our aim

is to educate folks about their results, advantages, and tips on how to achieve a

most wholesome way of life. The most typical symptom is

gynecomastia, the expansion and development of the mammary glands in males.

Nonetheless, legal alternate options available do

not come at such excessive dangers while offering similar benefits.

But you should use this steroid as a lot as weeks at low doses – hold watch for those virilizing symptoms over that length of time, significantly if you’re taking a dosage at the greater

end of the range above. At doses wherever above the female

recommended range of 5-10mg/day, virilization is undoubtedly a possibility.

Some girls can be sensitive sufficient at these low doses to experience negative effects, however as long as you reduce the dose or cease utilizing Anavar, they should go away alone.

Bear In Mind, consultation with healthcare professionals isn’t just advised;

it’s a vital dialogue—the bulwark that fortifies your endeavors and scaffolds your achievements on pillars of knowledge and care.

The oral model is definitely 17 Beta Alkylated, meaning it’s less liver-toxic than the 17 Alpha Alkylated.

There is a few truth to this, as far as anabolism goes, it is even barely weaker than Testosterone, but is significantly less androgenic.

A combination of proteins and Amino Acids along with PeakATP is

bound that will assist you slightly within the muscle gaining endeavor.

The use of insulin to boost athletic efficiency creates an instantaneous risk to one’s well being

and properly being. “Pyramiding” is one other kind of anabolic steroid

utilization individuals attempt to prevent harmful unwanted

side effects. You start by taking a low dose of a quantity of

anabolic steroids, after which improve your dosage over time.

Once you get to a maximum dose, you stop taking them for a relaxation period earlier than starting again. Oral steroids

are additionally hepatotoxic; subsequently, we regularly see deteriorations in hepatic

health from bodybuilders using them.

It is probably the most frequent opposed event in older males receiving testosterone alternative remedy (TRT) (40).

The 19-Nors are probably the most suppressive family of

the anabolic steroid household tree, and will maintain your HPTA suppressed even at minuscule hint amounts.

They usually are not substrates for aromatase like Testosterone derivatives,

they do not act as potent agonists of a myriad of various receptors within the body like 19-Nors, they usually do not 5α-reduce into more androgenic metabolites.

A common false impression is that steroids derived from DHT are assured to be extraordinarily androgenic just because they’re DHT derivatives.

These two anabolics were chemically designed to lack estrogenic activity and a capability to drive vital positive aspects

in mass, and be levered more in the course of pure protein expression and the neurological side of the spectrum.

Unlike the main three hormones used amongst bodybuilders on this household,

Turinabol and Halotestin are Testosterone derivatives that induce

results analogous to potent DHT derivatives. They all have strong

influences on red blood cell depend, energy techniques, and exhibit a hybrid of behaviors

within the body analogous to how endogenous steroidogenesis would

otherwise regulate balanced exercise.

Most cycles are based mostly on testosterone, while

the strongest steroids for bodybuilding, such as Anadrol

and Dianabol, contribute to rapid muscle mass build-up.

Winstrol, Masteron, and Anavar are among the many cutting brokers that assist in showcasing massively outlined,

highly vascularized muscles. Though all synthetics have advantages, they

want to be researched and used fastidiously to forestall health penalties.

The presence of an skilled coach is at all times useful to avoid the utmost attainable dangers while attaining objectives

at the desired degree. [6] These mechanisms could play a much bigger

function in the anabolic/anticatabolic actions of anabolic-androgenic steroids (AASs) than as soon as thought.

At physiologic testosterone levels, almost

all androgen receptors are engaged. Therefore,

supraphysiologic doses of testosterone or AASs would don’t have any increased anabolic

impact in wholesome athletes except other mechanisms of action existed.

Regardless Of its excessive market worth, it’s

usually coveted because of its versatility. Winstrol promotes reasonable increases in lean mass while lowering fat-free mass.

We find that testosterone is usually the first steroid a Intervallfasten: Vorteile für Bodybuilder will

take due to its gentle nature and security (in phrases of facet effects).

Anadrol may be a potent mass-building steroid; nonetheless, it’s also some of the toxic AAS (1), primarily based on our liver perform and lipid profile exams.

Anadrol will trigger hefty weight acquire, roughly 30 lbs from a

cycle, because of it being a moist steroid as properly as anabolic.

From sinus infections and hypertension to preventive screening,

we’re right here for you. Anabolic steroids (AASs) are derived from the primary

male hormone, testosterone.

In addition, it lowers corticosterone and cortisol levels, while concurrently

inhibiting cortisol from binding to skeletal

muscle glucocorticoid receptors. Nitrogen retention was roughly the identical between the entire steroids evaluated in the research above.

Males higher than 40 years of age with baseline prostate-specific antigen (PSA) greater than zero.6 ng/mL should have

their PSA ranges measured and a prostate examination at three to 6 months.

One animal research discovered that exposing male mice for one fifth of their lifespan to anabolic steroid doses corresponding to those taken by human athletes

caused a high frequency of early deaths eighty two.

It is extensively used therapeutically, in various esterified forms, as alternative remedy in male hypogonadism.

Testosterone, and a choose few different AAS such as nandrolone and oxandrolone, may also be

prescribed for other medical conditions (e.g., osteoporosis or aplastic anemia).

In Addition To this valid medical use, AAS are widely used – or rather, abused – for their muscle-building and strength-increasing properties in dosages far exceeding these used therapeutically.

For brevity, within the remainder of this review we

employ the time period ‘AAS use’ to check with the nonmedical high-dose abuse of AAS.

They lock extra nitrogen into your muscle cells, creating the perfect environment for

development. Each steroids supply the identical muscle-building potential, since they ship identical nandrolone.

TRT is generally protected for males with low testosterone levels when administered by a medical professional.

Most people normally don’t get Omega three in their diet, and I can guarantee you the

typical fitness center goer gets even less. Omega 3 may help with fighting inflammation, insulin resistance, reducing

fatty liver, and reduces liver enzymes. Particularly if you’re running orals,

Omega three supplementation might help. DHB is extremely anabolic (5x that of Testosterone), and super for

energy. DHB doesn’t Aromatise into Estrogen, but then again it holds

hepatotoxic qualities (liver toxicity) even in injectable type.

Other unwanted side effects of DHB are apparently much like those of Trenbolone.

The cycles of steroid use are normally six to 12 weeks long,

followed by a relaxation period. Long‑term use may lead to hormonal imbalance, liver

or kidney damage, elevated ldl cholesterol, blood pressure

spikes, bone loss, temper problems, infertility, and, in severe instances,

organ failure. Water retention, elevated blood stress,

liver strain (especially with oral forms), and suppression of your own testosterone production. Some athletes could appear to

get an edge from performance-enhancing medicine. Athletes take human development hormone, additionally referred

to as somatotropin, to construct more muscle and do higher at their sports.

But studies do not clearly show that human progress hormone boosts energy or helps people exercise longer.

Misinformation is frequent, particularly on-line, where steroids could also be promoted as protected and efficient for everybody.

Both TRT and steroids affect your body’s pure hormone balance, and making the incorrect alternative can have lasting penalties.

Low testosterone is linked to melancholy, irritability, and temper swings.

By balancing testosterone levels, TRT can stabilize temper and improve mental well being.

Then, you additionally add injectable testosterone and PCT with Clomiphene (Clomid) and Tamoxifen (Nolvadex).

The addition of injectable testosterone is to have a excessive quality testosterone base that also helps together with your

joints and overall well-being. This is a considerably stronger SARM

for bulking; Ibutamoren mixed with Testolone will increase urge

for food and the power to make more significant positive aspects

in case your diet helps it. Because the SHBG binding affinity

with SARMs is normally much larger, and this causes a significant improve in free testosterone18.

Increased androgenic and estrogenic unwanted side effects – precisely the things you hope to avoid through the use

of SARMs. MK-677 is amongst the more distinctive compounds with the exciting benefit of doubtless having some anti-aging effects.

The long half-life of Equipoise means it takes longer to exit your

system. This is one other good cause to begin with

a really low dose if it’s your first time using this steroid.

Primobolan is another steroid derived from DHT, which is comparatively female-friendly at lower doses.

They ought to permit you as a feminine user to keep away from androgenic

side effects of a virilizing nature. Still, as always,

you ought to be open to experimenting with completely different dosages and

decreasing it if required – relying on your tolerance of unwanted effects.

At doses anywhere above the female recommended vary of

5-10mg/day, virilization is undoubtedly a chance.

What is generally accepted is that SARMs have milder unwanted effects than anabolic

steroids and that some side effects brought on by steroids don’t occur at

all with SARMs or are in any other case mild. The lack

of estrogen (which men want at very low levels) is the principle cause you need a testosterone base on SARMs because SARMs don’t convert to

estrogen as testosterone steroids can. I’ve included it right here because it’s something that SARM customers will often come

throughout as a suggestion, however men put themself at risk

of feminization. The function of post-cycle remedy (PCT) for males who use anabolic steroids is to assist and promote the restoration of standard testosterone production that has been curtailed or shut down by means of steroids.

Cardarine at 20mg every day and Ostarine at 20mg daily is a standard strategy.

Larger doses of Masteron may end up in extreme muscle

tightening; 300mg per week of Masteron will present the most

effective results for most users. The half-life of a steroid provides you a way of understanding how

lengthy that steroid will remain active in your system at a degree where performance and physical advantages might be

noticeable and achievable. Once you’ve injected, the ester starts to detach from the

hormone, and the place it is a long ester, it may possibly take every week or two before the results of the steroid

kick in. It additionally takes longer to exit your system once you cease injecting, and

this impacts whenever you begin PCT. Some Tren users report some type of hair loss whilst

taking Trenbolone. Nonetheless one person (who did) claimed that 80% of it came back after his cycle finished, so this is largely a brief

aspect impact. The cause why blood pressure increases on Tren is as a outcome of it

raises Testosterone ranges A LOT.

References:

PedsElite